Purchasing a property is most likely the biggest financial decision you will ever make. Whether this is your first purchase or you are an experienced buyer, this decision must be made carefully.

Why Do You Want To Buy?

Are you tired of paying rent? Have you decided to pay your own mortgage and not your landlord’s? Have you outgrown your current home? Are you looking for an investment portfolio? Are you looking for a rental property? Would you like a larger yard? Would you rather live in a different area? Do you want to shorten your commute? Having a clear sense of your reasons for buying will help you choose the right property.

Has Your Income Grown?

Property ownership is an excellent investment; whether you are looking for your dream home, a rental property, or to expand your investment portfolio. Owning real estate is one of the least risky ways to build equity or to obtain a greater return on your initial investment.

Ready to find out more?

View our Guide to Buying

Build Your Green File:

- Copy of one month’s recent and consecutive pay stubs

- Copy of last two years of W-2 statements

- Copy of last two years of personal tax returns (1040s)- all pages

- Two months of asset account statements- all pages and all accounts

- Copy of fully executed contract of sale

- Copy of photo identification, such as a valid driver’s license or passport

- Credit Inquiry letter- A letter explaining if any recent credit inquires have resulted in any new debt

Additional documentation may be required if:

- You own additional properties

- You have had credit issues in the past

- You are receiving gift funds to use as a down payment on your purchase transaction

- You are a permanent resident alien, or are in the U.S. on a work visa

- You receive or are required to pay alimony or child support

- You receive social security, pension benefits or disability income

Purchase Timeline

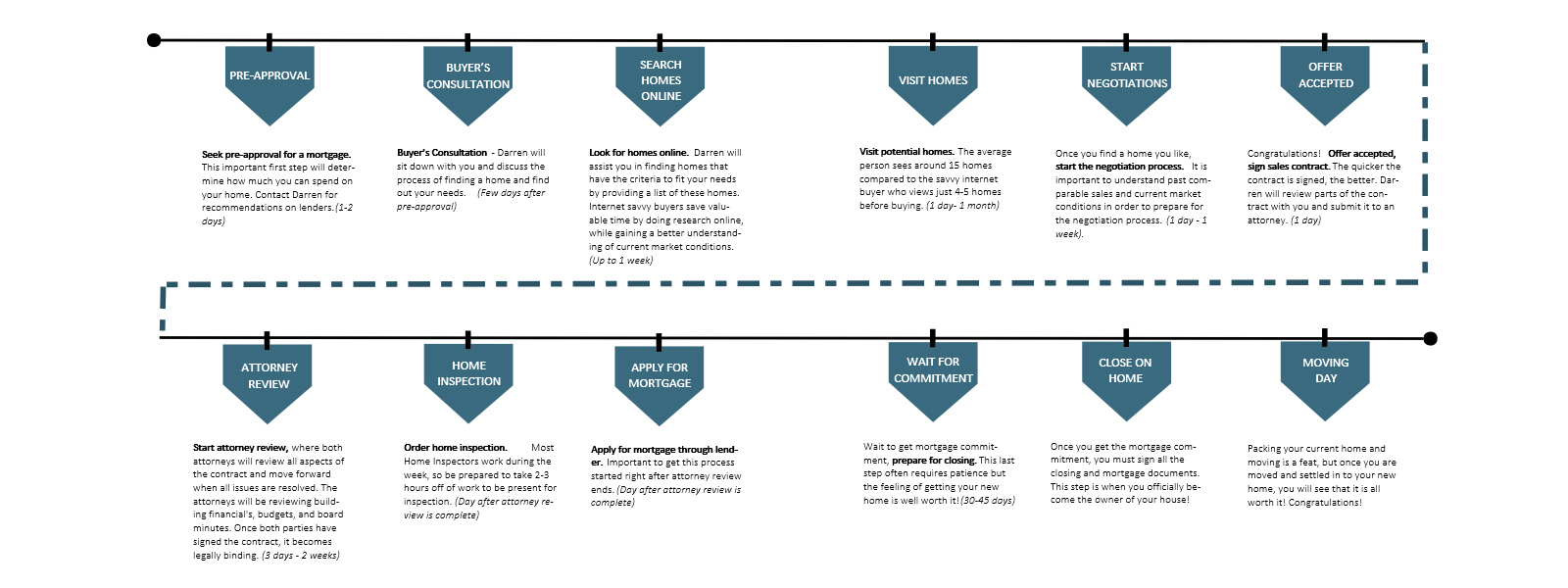

1. PRE-APPROVAL

Seek pre-approval for a mortgage. This important first step will determine how much you can spend on your home. Contact Darren for recommendations on lenders. (1-2 days)

2. BUYER’S CONSULTATION

Buyer’s Consultation - Darren will sit down with you and discuss the process of finding a home and find out your needs. (Few days after pre-approval)

3. SEARCH HOMES ONLINE

Look for homes online. Darren will assist you in finding homes that have the criteria to fit your needs by providing a list of these homes. Internet savvy buyers save valuable time by doing research online, while gaining a better understanding of current market conditions. (Up to 1 week)

4. VISIT HOMES

Visit potential homes. The average person sees around 15 homes compared to the savvy internet buyer who views just 4-5 homes before buying. (1 day- 1 month)

5. START NEGOTIATION PROCESS

Once you find a home you like, start the negotiation process. It is important to understand past comparable sales and current market conditions in order to prepare for the negotiation process. (1 day - 1 week).

6. OFFER ACCEPTED

Congratulations! Offer accepted, sign sales contract. The quicker the contract is signed, the better. Darren will review parts of the contract with you and submit it to an attorney. (1 day)

7. ATTORNEY REVIEW

Start attorney review, where both attorneys will review all aspects of the contract and move forward when all issues are resolved. The attorneys will be reviewing building financials, budgets, and board minutes. Once both parties have signed the contract, it becomes legally binding. (3 days - 2 weeks)

8. HOME INSPECTION

Order home inspection. Most Home Inspectors work during the week, so be prepared to take 2-3 hours off of work to be present for inspection. (Day after attorney review is complete)

9. APPLY FOR MORTGAGE

Apply for mortgage through lender. Important to get this process started right after attorney review ends. (Day after attorney review is complete)

10. WAIT FOR COMMITMENT

Wait to get mortgage commitment, prepare for closing. This last step often requires patience but the feeling of getting your new home is well worth it! (30-45 days)